sales tax on food in memphis tn

Sign up for E-Newsletter. The Memphis sales tax rate is.

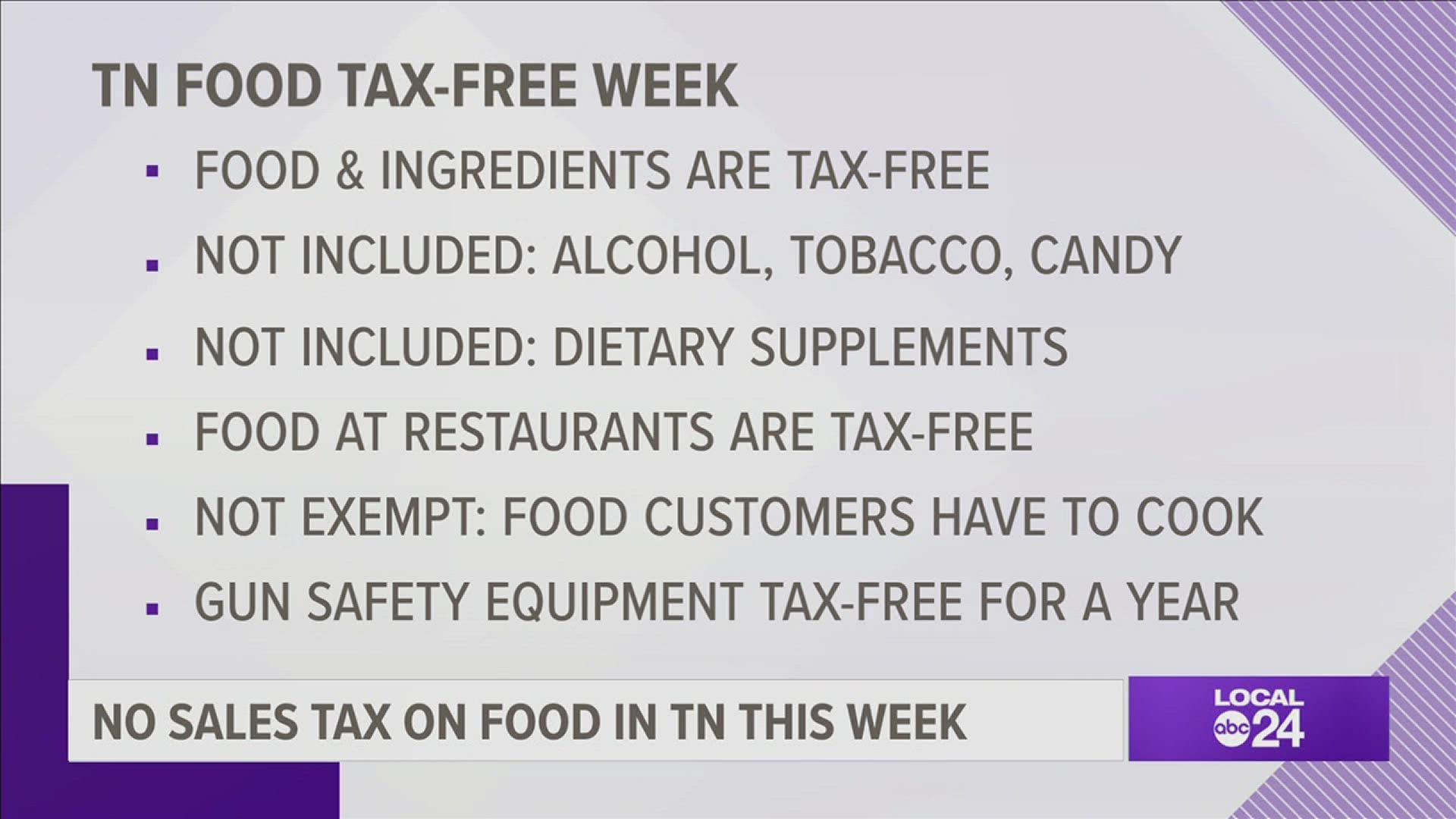

Tn Has Its First Ever Tax Free Week On Food Localmemphis Com

These food items must be in packaged or original form and not prepared by the seller or served as a ready-to-eat meal.

. Spring Hill TN Sales Tax Rate. One of just three states thatll charge you the same sales tax on food 7 as it does everything else. Properties Available for Sale.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top of the state tax. Memphis TN 67 Memphis TN. There is no applicable special tax.

There is an income tax on interest and dividend above a certain amount. Currently all Tennesseans pay a 4-percent state sales tax on food items. City-Data Forum US.

Sales tax in Shelby county is. Payment for Tax Sale Purchases. Prepared food in Tennessee is defined as.

Food in Tennesse is taxed at 5000 plus any local taxes. Did South Dakota v. Prepared meals are fully taxable at the state sales tax rate of 7 plus local tax.

See reviews photos directions phone numbers and more for Sales Tax locations in Memphis TN. Please click on the links to the left for more information. Tennessee has recent rate changes.

The Shelby County Trustee does not offer tax lien certificates or make over the counter sales. The Shelby County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Shelby County local sales taxesThe local sales tax consists of a 225 county sales tax. Because these sales are for consumption off the premises the liquor-by-the-drink tax imposed by Tenn.

When he took office in 2011 the tax on food was 55 percent. Food sold with eating utensils such as plates knives. Apply to Sales Representative Night Auditor Senior Tax Accountant and more.

Someone was telling me that Tn doesnt have any or very little income tax. The sales tax is comprised of two parts a state portion and a local portion. The local tax rate varies by county andor city.

Food in Tennesse is taxed at 5000 plus any local taxes. 21950 for a 20000 purchase Memphis TN 975 sales tax in Shelby County 21700. Also they said that Tn makes that up by having a higher sales tax.

Companies must create at least 25 net new full-time jobs and invest at least 500000 in a. Here are some examples. Businesses should not collect the liquor-by-the-drink tax on these sales either by adding.

New South Memphis TN Sales Tax Rate. 57-4-301 does not apply. Reducing the tax on food and food ingredients has long been a priority for Gov.

Tennessee is one of only 13 states of the 45 that have sales tax to tax food at either the general or a reduced rate. The general state tax rate is 7. For tax rates in other cities see Tennessee sales taxes by city and county.

The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax. To review the rules in Tennessee visit our state-by-state guide. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

See reviews photos directions phone numbers and more for the best Property Maintenance in Memphis TN. What salary does a Sales Tax earn in Memphis. The Shelby County Sales Tax is collected by the merchant on all qualifying sales made within Shelby County.

Tennessee has a lower. No liquor-by-the-drink tax should be charged on take-out or delivery sales while the Executive Order is in effect. Smyrna TN Sales Tax Rate.

Shelby County collects a 225 local sales tax the maximum local sales tax. Memphis TN Sales Tax Rate The current total local sales tax rate in Memphis TN is 9750. Forums Tennessee Memphis.

125 Sales Tax Salaries in Memphis TN provided anonymously by employees. Wayfair Inc affect Tennessee. State income tax sales sales tax food.

Oakridge TN Sales Tax Rate. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. Has impacted many state nexus laws and sales tax collection requirements.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. The 2018 United States Supreme Court decision in South Dakota v. Did South Dakota v.

Food and food ingredients are things you can eat that are consumed for taste and nutritional value. State Sales Tax Food Now4 Rate on bakery goods and heat and eat meals sweet semi-sweet. Food sold in a heated state or heated by the seller Food that contains two or more food ingredients mixed together by the seller for sale as a single item.

State Tax Rates. Thanks to the IMPROVE Act the state sales tax rate on food and food ingredients has been reduced 20 from 5 to 4 plus local sales tax rate. Memphis collects the maximum legal local sales tax.

For Arkansans the tax is. This incentive provides a credit of 4500 per job to offset up to 50 of franchise and excise tax FE liability in any given year with a 15 year carry-forward. In all other states sales of food and food ingredients are exempt.

Just relocated to Memphis and am wondering if in light of the three-state border whether sales taxes are materially higherlower enough in one state to make it worth the trip. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. With local taxes the total sales tax rate is between 8500 and 9750.

975 sales tax in Shelby County. Find sales tax rates in Tennessee by address or ZIP code with the free Tennessee sales tax calculator from SalesTaxHandbook. You can print a 975 sales tax table here.

2759 Mahue Dr Memphis Tn 38127 Realtor Com

3785 W Germanwood Ct Memphis Tn 38125 Mls 10121042 Redfin

4838 Beaconfield Cv Memphis Tn 38141 Mls 10106992 Redfin

Abandoned Ashlar Hall Castle 1397 Central Avenue Memphis Tn Steven Dunlap Bought It And Restored It Ea Old Abandoned Houses Abandoned Places Abandoned Houses

Memphis Tn Homes For Sale Property Search Results Crye Leike Com Page 1

2993 Sky Way Dr Memphis Tn 38127 Realtor Com

10 Pros And Cons Of Living In Memphis Tn Right Now Dividends Diversify

1755 Jackson Ave Memphis Tn 38107 Realtor Com

Big Man Chairs Home Decor Interior Design Free Shipping No Sales Tax No Interest Financing Add To Amazon Car Man Living Room Leather Chair Abbyson Living

3947 Carter Ave W Memphis Tn 38122 Mls 10107446 Redfin

Big Man Sofas Near Me Free Shipping Save On Sales Tax No Interest Financing Living Spaces And Ideas Manly Living Room Living Room Chairs Cushions On Sofa

Charlie Vergos Rendezvous Home Memphis Tennessee Menu Prices Restaurant Reviews Facebook

387 Angelus St Memphis Tn 38112 Mls 10107675 Redfin

1750 Crump Ave Memphis Tn 38107 Realtor Com

Fabulous Flavors Friends Food Truck Restaurant Home Memphis Tennessee Menu Prices Restaurant Reviews Facebook

Beyond The Blues Discover The Many Faces Of Memphis Tennessee

Beale Metroscenes Com Great Shots Here Memphis Skyline Beale Street Memphis Memphis